| Home DH-debate |

| 1. Introduction | 2. Say's Law |

| 3. Quantity Theory | 4. Banks' Money Creation |

| 5. Price Statistics | 6. Knut Wicksell |

| 7. The Business Cycle | 8. Free Banking |

| 9. Literature |

Odysseus had to sail through the strait, where the whirlpool Charybdis threatened at one bank, and the many-headed monster Scylla lurked on the other side. Similarly, ordinary savers must choose whether to keep their saving on a simple bank account or in bonds representing fixed amounts, thereby exposing themselves to inflation, or to venture into the stock market, where experienced investors are lurking and with the greatest matter of course take their "cut".

Many savers feel that when the principles of the Austrian School are implemented, inflation and endless price increases will end, and they can be allowed to have their life's savings in peace without exposing themselves to the risks of the stock market.

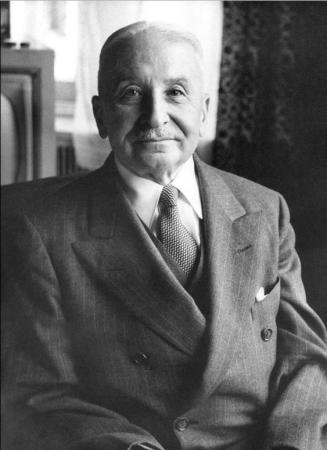

Ludwig von Mises 1881 - 1973. Photo Dick Clark Mises Wikipedia.

The US is not a welfare state that promises taxpayer-paid pension and numerous additional benefits to those, who have had the foresight not to save for their old age. Everyone has to take care of themselves by saving. Therefore, the Austrian Economic School is very popular in this country, many American websites profess to the Austrian theories.

The Austrians Ludwig von Mises and Friedrich Hayek are the most famous representatives of the Austrian Economic School.

Ludwig von Mises was born in Lemberg, now part of Ukraine, by Jewish parents in 1881. His father was a railway engineer. One of the Mises family's ancestors was made nobleman by Emperor Frans Joseph of Austria-Hungary; hence the term "von" in his name. Ludwig grew up in Vienna.

Mises was an economic adviser for the Austrian government Dolfuss 1932-34.

Dolfus was murdered by Austrian Nazis in 1934, and von Mises fled to Switzerland and from there to the United States where he lived the rest of his life.

His principal work is the "Theory of Money and Credit," published for the first time in 1912. It became a textbook in banking.

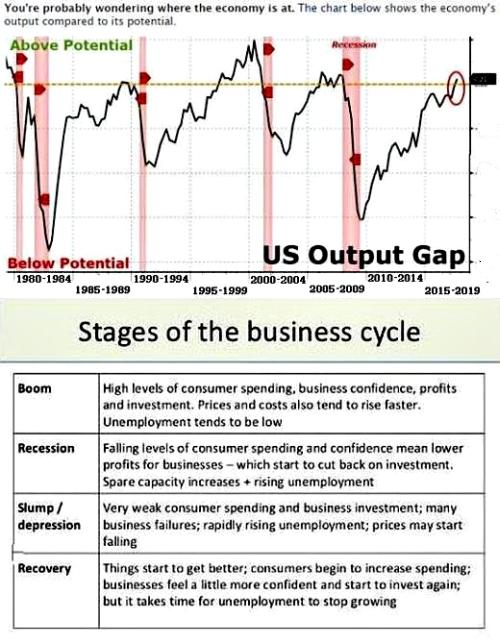

The business cycle illustrated by US output. The vertical axis measures output and the horizontal represents time. The horizontal yellow line represents full capacity. Below are the four phases of the cycle explained. At the boom, the economy is at the top. Recession means decline. During depression the economy is at the bottom. At recovery, it begins again to improve. From respectively Zero Hedge and slideshare.net.

In this book, he argues that the recurring economic crises, "The Business Cycle", are caused by an uncontrolled expansion of bank credit.

In 1922 he published the book "Socialism". That was five years after, the Soviet Union has been founded.

Socialism would inevitably fail, he wrote. Since there is no market, which can define a price, it would not be possible to make economic calculations. It would therefore not be possible to calculate, whether one or another economic alternative would be the most advantageous to implement. Therefore, a socialist economy cannot become optimized, and for this reason, socialism would fail.

Ludwig von Mises never really got a foothold in the academic world in the United States. His ideas were too controversial for the economic professors, who in the post-war era were more inspired by the Englishman John Maynard Keynes' ideas.

He died in New York in 1973 as a man of relatively small means.

But today, the Austrian Economic School is very popular, especially in the U.S. Numerous financial websites profess to Mises and Hayek theories.

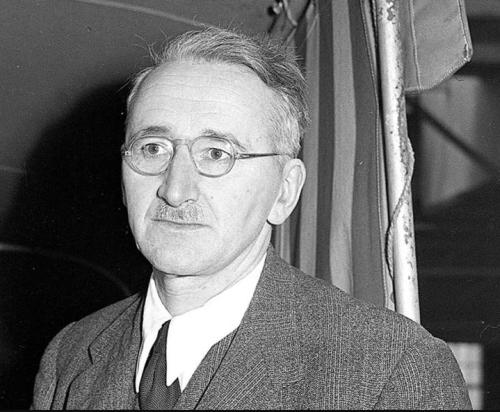

Karl Hayek 1899-1992 photographed when he won the Nobel Prize in Economics in 1974. Photo: The School of cooperative individualism.

Karl Hayek was born in Vienna in an aristocratic Austrian family in 1899. He was distantly related to the philosopher Ludwig Wittgenstein. Hayek was a student of Mises. When the First World War broke out in 1914, he joined the army. He survived the war and was decorated for bravery. He lived a great part of his life in England.

Hayek received the Nobel Prize in Economics in 1974 for his work on "The Business Cycle". He believed, that the governments and the central banks' faulty monetary policy could explain the economic situation of society with its regularly recurring crises and unemployment. This means that their attempts to stimulate the economy with money creation and low interest rates, in fact, laid the foundations for new continually evolving crises.

His principal work is the "Road to Serfdom" from 1944. He warned his English countrymen, that the central planning, that was practiced during the Second World War, should cease, as soon as the war ended. Otherwise, it would lead to socialism. Under socialism, he wrote, the economic planning inevitably would fall back into the hands of a small group of key persons. They would be unable to process the overwhelming amount of information, and the succeeding chaos would pave the way for a dictatorship.

|

|

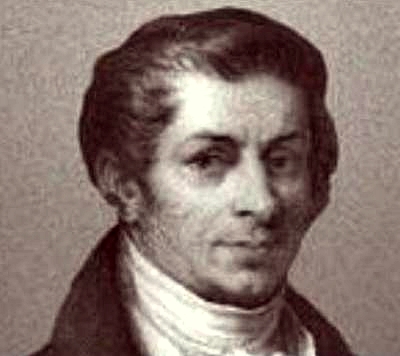

Pro: Jean-Baptiste Say was an economist and businessman. He lived in France in the time of the French Revolution. He is best known for his "Says Law".

Jean-Baptiste Say 1767-1832 was born in Lyon, France. He worked in England until 1786, where he was employed by a life insurance company in Paris. He was 22 years old when he saw the French Revolution. He got trouble with Napoleon in 1804 and founded a textile factory in Calais. He wrote a series of books on economy and freedom of the press.

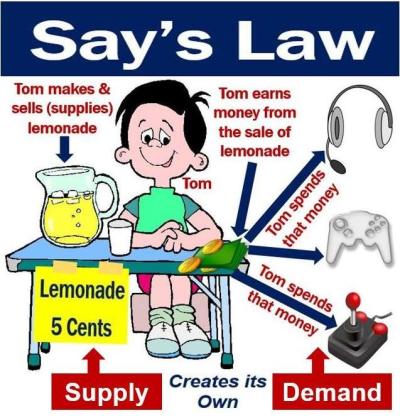

For economists of the Austrian school, Say's Law is what Newton's laws are for physicists. The law says "A product is no sooner created, than it, from that instant, affords a market for other products to the full extent of its own value"; which usually is expressed: "Supply creates its own demand.". It should be understood that when a businessman produces and supplies a product or service on the market, he will receive sales revenue that he immediately will use to demand other goods and services that he believes he needs - private or for new business. His supply is thus immediately transformed into a demand of the same size as his supply.

As the total market's supply and demand is the sum of all agents' supply and demand, the total supply and total demand will therefore also be of exactly the same size. Thus, according to Say's law, there can never be a general overproduction - that is, a situation where supply is greater than demand, a general "bubble".

However, this does not exclude the possibility of overproduction and bubbles in separate industries, which, however, will be counteracted by a corresponding shortage in other industries; with Say's own words: "If certain goods remain unsold, it is because other goods are not produced."

Illustration of Say's Law. The point is that a businessman will only keep the liquidity that seems to him strictly necessary - as illustrated by the economic textbooks' liquidity analyzes. For the rest of the money, he will immediately buy materials, goods or the like, from which he believes he can benefit in the future, thereby creating the demand for other businessmen's products. Drawing: Market Business News.

Say's law is one of the most important theories in support of the laissez-faire idea that a capitalist economy is basically in balance, as it without state intervention will have a natural tendency to stability, prosperity and full employment.

Even Platon in ancient Athens knew that it is usually not a good idea to hold too much liquidity. In Socrates' discussion with Polemarchus in the Dialogue Republic about justice, he lets Socrates say: "What then is the use of money in common for which a just man is the better partner?" Polemarcus answers: "When it is to be deposited and kept safe, Socrates". Socrates: "You mean when it is to be put to no use but is to lie idle?" "Quite so", Polemarchus says, and Socrates concludes: "Then it is when money is useless that justice is useful in relation to it?"

In the literature one can find that Say's law says that "Human needs are endless and insatiable". It has Say never said, probably because, he considered it self-evident. The insatiable human needs are a tacit precondition for Say's Law, as the businessman above will not be motivated to spend the money that he has earned if not his needs are strong enough.

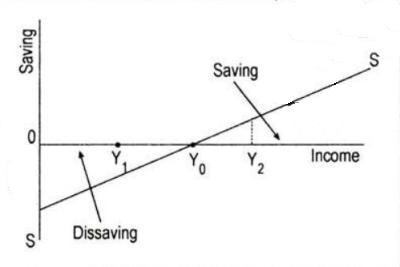

Contra: Keynes considers saving as a function of income, which means that when people earn more money, they will consume relatively less and save more, which sounds very reasonable. It indicates that he did not think that human needs are unconditionally endless and insatiable.

For the classical economists saving was a function of interest rates so that a high interest rate motivated individuals to save. For Keynes, savings were a function of income, so that individuals with high income would save more than people with low income. Which means that a high-income society will save more than a society with a low-income level. Which suggests that he did not think that human needs are infinite and insatiable. From Economics Discussion.

In the introduction to "General Theory" Keynes pointed out also another implicit condition for Say's law, which is rarely met: "Say was implicitly assuming that the economic system was always operating up to its full capacity, so that a new activity was always in substitution for, and never in addition to, some other activity. Nearly all subsequent economic theory has depended on, in the sense that it has required, this same assumption. Yet a theory so based is clearly incompetent to tackle the problems of unemployment and of the trade cycle."

Unlike Say, Keynes stressed the importance of the speculative demand for money.

The classical economists including the Austrian economists did not recognize the speculative demand for money. They believed that cash does not give interest or yield, and therefore the businessmen as far as possible will seek to minimize their cash holdings, as described in numerous textbooks. Which supports Say's Law, saying that agents in the economy do not want to hoard cash, but will immediately use the money to buy something that they believe they can benefit from in the future.

Disney's Joachim von And. In uncertain times with low or negative interest rates, cash can be an excellent passive investment.

The speculative motive entails investing in a cash portfolio. In uncertain times, without significant inflation and with low or negative interest rates, cash is an excellent passive investment, better than bonds. If investors or businessmen expect a price drop, they will increase their cash holdings so they are ready to buy, when the price bottoms.

For example, Warren Buffet's investment company Berkshire Hathaway has recently - the summer of 2018 - transferred into cash an amount equivalent to six Great Belt Bridges. Probably tens of thousands of other investors and businessmen have done the same thing.

But the speculative motive for holding liquidity sends a torpedo against Say's Law, which presupposes that the agents' revenue from their sales - from their supply - immediately returns to the market as demand, thus maintaining the balance between supply and demand and the stability of the whole economy.

|

|

Pro: The quantity theory of money is a socio-economic theory, which predicts that price level is a linear functions of the money supply. It is very important for the group of economists, called Monetarists.

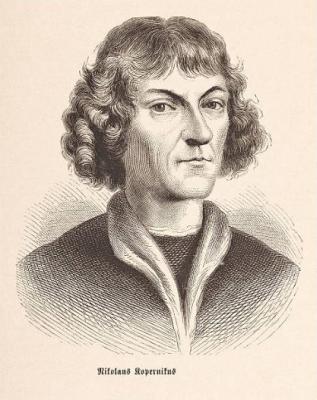

Nicolaus Copernicus. The quantity theory of money can be traced back to Copernicus. The story is not unconnected to Mises's proposal for free banking.

King Sigismund I of Poland asked Copernicus to come up with a proposal for a reform of the country's currency, which was in a deplorable condition. The Prussian Poland, where Copernicus lived, had three different currencies: namely Royal Prussian coins, the Polish kingdom's coins and the Teutonic Order's coins. None of them maintained a standard weight. Especially the Teutonic Order's coins were constantly devalued by containing less and less silver. He delivered his proposal to the king in 1517.

Copernicus' treatise, "Monetae Cudendae Ratio", is a contribution to monetary theory. He began with the insight that money is a common measure of market value. He then proceeded to show that cheap coins will tend to replace the more expensive ones. It is impossible for good full-weight coins and devalued coins to circulate together; All the good coins will be accumulated among the citizens as savings, melted or exported, and only the devalued coins will remain in circulation, as they are the ones that the citizens prefer most to get rid of. He formulated an early version of the quantity theory of money. He concluded that in theory, the government could continue to issue several different coins, but in practice, it would be an overly difficult task. Foto Pinterest.

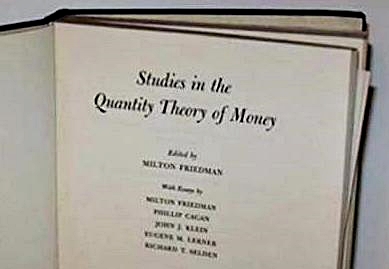

The leading Monetarism economist Milton Friedman is known to have said: "Inflation is always and everywhere a monetary phenomenon;" Which covers his belief that inflation is created by the supply of money and can be controlled by a restrictive monetary policy that annually increases the money supply only by the percentage which inflation is desired to be.

Mises, Hayek and other Austrian economists supported the quantity theory of money, only they stressed that by increasing the amount of money, some individuals will be in possession of this money before others, and prices of some goods will rise before prices of other goods. Their many attacks on central banks to manipulate the supply of money without appropriate knowledge and thereby unintentionally create economic crises, show that they think it is self-evident that there is a causal link between money supply and price level.

The quantity theory of money was the basis of all the monetarist theory. Milton Friedman wrote a whole book about it. Photo Pinterest.

Contra: Keynes maintained that the essence of the market is supply and demand of goods and services; The market basically consists of agents, who have and want to sell, and other agents, who do not have and would like to buy. Money is only a medium that makes it all work efficiently - a kind of lubricant. As he wrote in an open letter to President Roosevelt "The other set of fallacies, of which I fear the influence, arises out of a crude economic doctrine commonly known as the Quantity Theory of Money. Rising output and rising incomes will suffer a set-back sooner or later if the quantity of money is rigidly fixed. Some people seem to infer from this that output and income can be raised by increasing the quantity of money. But this is like trying to get fat by buying a larger belt. In the United States to-day, your belt is plenty big enough for your belly. It is a most misleading thing to stress the quantity of money which is only a limiting factor."

But in "General Theory" - like all other economists - Keynes reluctantly had to admit that there is a causal link between money supply and price level, at least in the long run: "Money and the quantity of money, are not direct influences at this stage of the proceedings. They have done their work at an earlier stage of the analysis. The quantity of money determines the supply of liquid resources, and hence the rate of interest, and in conjunction with other factors (particularly that of confidence) the inducement to invest, which in turn fixes the equilibrium level of incomes, output and employment and (at each stage in conjunction with other factors) the price-level as a whole through the influences of supply and demand thus established."

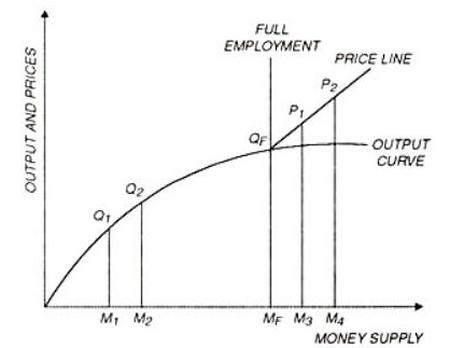

Keynes about the quantity theory of money. He states that prices are primarily determined by production costs. He believes that changes in the amount of money do not directly affect price levels, but indirectly through interest rates and resulting investment levels, profit, production and employment. He did not think that the price level increases directly proportional to the money supply.

If the amount of money in an idle capacity situation increases from M1 to M2, output will only increase from Q1 to Q2, while price levels will not be affected - because new employees are being recruited for the same or lower pay and investments are not effective so quickly. Only when the money supply reaches Mf and output reaches Qf - that is at full employment - the price level begins to move. An increase in the amount of money under full employment from M3 to M4 will increase the price from P1 to P2 - because workers and subcontractors are now in a situation, where they can demand wage increases and higher prices - but it will not affect output significantly. From Economics Discussion.

In modern times, "Quantity Theory of Money" has very much become an important topic in connection with many central banks "quantitative easings". This monetary policy includes that the central bank "print" some billion money that it uses to buy government and corporate bonds from banks. The increased demand for bonds will cause the price to rise and hence the interest rate to fall, and it is hoped that the lower interest rate will motivate businessmen to borrow money and start new projects, thus making more economic activity in society. At the same time, it is hoped that banks will use some of their increased liquidity for increased lending to new projects. It is easy to see that "quantitative easing" involves an increased money supply.

Central Banks' quantitative easing. Supporters of quantitative easing indicate that it works, it lower interest rates and increases activity. They believe that given how close many economies are to actual deflation, we should not wrinkle on our noses for only a slight increase in inflation.

Opponents of quantitative easing - including Austrian economists - think that the easings create a dangerous financial unstability. They think that continuous low interest rates make the investors to engage in scaring risky investments - based on volatile marginal needs -in their search for profit. If/when these projects fail, it will trigger the economic crises of the century.

Another critic of quantitative easing says that it increases inequality. When central banks buy bonds the price of these increases, and as the rich own most of these financial assets, their fortunes will increase. Besides, if one is already rich and can offer guarantee, it is most likely easy to get a bankloan and use it to buy some shares, which in average increase in value because of the increased demand. Graph: The Economist.

The success criterion for the strategy, "quantitative easing", is emerging of a slight inflation as a sign that the economy has regained its health, and the wheels of the national economy again are turning.

Japan used extensive "quantitative easing" in the 1990s, and they most likely still do. The American Central Bank, Federal Reserve, has for many years bought bonds for big amounts of "printed" money. The Bank of England and the European Central Bank do it. But until now, they all have largely in vain been watching for beginning inflation. However, stock prices during the same period have risen steadily with some interruptions.

The central banks have pumped liquidity for many billions into the economies, but inflation has nevertheless been insignificant. It creates suspicions that the "Quantity Theory of Money" is not true; or, perhaps we still can get the inflation in the future, as Austrian economists have predicted many times.

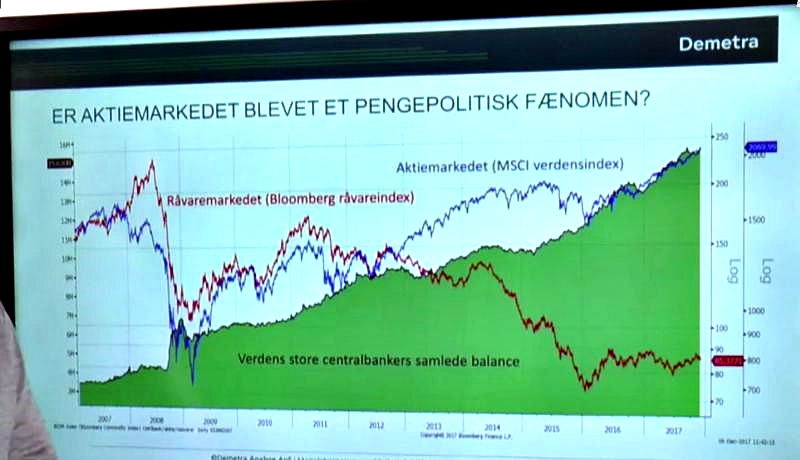

|

The global central banks' overall balance sheets (the green area) compared to the world stock index (the blue graph) show a good correlation. The commodity index (the red graph) can be seen as the industry's demand for raw materials and thus industrial activity. The declining commodity index indicates declining industrial activity. One can get the idea that the banks create some money that they lend out and the borrowers buy shares for the money instead of investing in new projects. The quantity theory for money is thus valid, but only for the price of shares. Screenshot from lectures by the financial advisory company Demetra from Børsen Play.

|

|

In the 1970's, Keynes national economic theories were partially displaced by the monetarism represented by - among others - Milton Friedman. They believed that the capitalist economy was stable and self-regulating, and if only the money supply was maintained at a stable level, inflation would be avoided - following the "Quantity Theory of Money".

Today, however, most central banks have left the idea of managing the economy by controlling the money supply - acknowledging that this is not possible. Because, it is not only central banks that issue money, they are also created by private banks.

C. F. Tietgen 1829-1901, born in the city of Odense. He was one of the great men of the Industrial Revolution in Denmark. Based on Denmark's first private bank, Privatbanken, he founded a number of Denmark's leading companies, many of which still exist. He was religious and patriotic. He completed the building of the Marble Church in Copenhagen for his own money, and he arranged that the queen of Christian 2.'s body to be transferred from Belgium to a grave in the crypt of Sct. Knud's Church in Odense next to her royal husband. Photo: "Danske Stormænd fra de Seneste Aarhundreder" by L. F. La Cour and Knud Fabricius - Wikipedia.

The story of how the young C.F. Tietgen managed to lend out more money than his bank had in stock illustrates private banks' money-creation.

In December 1857, the Danish state-owned "Loan Fund" addressed the newly founded Private Bank's twenty-nine-year old manager, C.F. Tietgen, and asked for a loan of several million Rigsdaler. They intended to use the money to lend to savings banks, manufacturers and other companies, which had problems because of the difficult times. As a guarantee, they offered a large number of sterling cheques, which the government had received in connection with the abolition of the "Sound Due".

The new "Privat Banken" had not nearly enough money to cope with such a large payout. But on 21. of December Tietgen gave the following commitment: "Tomorrow, 1 million Rigsdaler, the day after tomorrow 0.5 million and the rest after the holidays."

Tietgen knew that loans create deposits. The receivers of the money would not like to keep such large amounts of cash in their private homes, particularly not during the Christmas holidays. They would as fast as possible place the money in the bank. And as the newly founded "Privat Banken" was the only private bank in Copenhagen, a very large part of the money would quickly return to there, and then they could be paid out a second time.

All our money is in the bank all the time. Foto: Stuff.

Even though nowadays there are many banks in Copenhagen, they need not be afraid that lending money will not come back as deposits. All money belonging to the citizens and the companies are namely in the banks all the time.

Moreover, today's banks do not have to worry about if their holdings of banknotes and coins, also are big enough to meet unexpected claims. Cash is largely replaced by "account money", that the banks themselves can create.

Today, mainly elderly people, criminals and tax evaders are using cash. By far the majority of the bank's customers use payment cards, and the payments that they make return to a bank in a fraction of a second.

When we make a payment with a debit card, we simply move the money from one bank account to another, possibly from one bank to another. When we do our daily shopping, we pay with a card, and the money is moved from our account in a bank to the store's account in a bank. Only in the few milliseconds, it takes for some electrons to move from one account to another, one can say that the money is not in a bank.

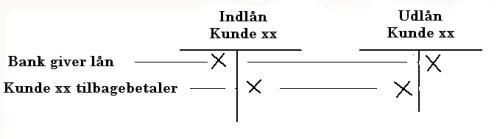

The banks and for that matter the central banks probably create money through balance sheet extensions, which means that they increase both assets and liabilities, so that the bank marginally becomes a more valuable company. If they give a loan to an individual or company in account money, it is obvious an increase in assets, as it is an asset to have a receivable. It will probably be offset in some form of equity-account, which is a liability. When the customer repays his loan, it will opposite represents a balance shortening. We notice that the borrower's consumption possibilities are increased - but not at the expense of someone else's consumption possibilities.

It is assumed by some that about 95% of the circulating money supply is created in this way, and that Denmark's National Bank's printing of banknotes only constitutes about 5% of the money supply.

When the bank's customers use the loans they have received, they will pay for different things and the money will be transferred from this bank to many different banks. However, when all banks offer credit on roughly the same terms, they will retain roughly the same market shares and a given bank will receive approximately the same amount as payments from countless individuals and companies that they make outgoing payments on behalf of their own customers. The bank's holdings will be fairly stable.

Keynes describes in "The pure theory of money" how banks can create as much money as they want by maintaining roughly the same credit policy and extending their lending at the same time: "It is evident that there is no limit to the amount of bank money, which the banks can safely create provided they move forward in step."

|

Victorian data processing. New York Clearing House around 1853. Head clerks from each of the city's banks present checks for cashing for the other banks around the Oval Table. This clearing typically lasted six minutes. Clearing means that banks will deduct their mutual claims so that they only owe each other net amounts. It also takes place today in Denmark, but electronically every night. From Campbell-Kelly, M. Wikipedia.

The Wikipedia article on money creation (see link below) tells that private banks buy government bonds from the state for money that they create with their bookkeeping and thus make themselves worthy to receive interest paid by taxpayers: "Thus, a modern state often provides new money by asking private banks to create them through bookkeeping. As a receipt, the bank concerned receives a paper (since the 1980's: an electronic contract), a so-called government bond, whereby the government promises to repay the amount with interest." When the bonds expire, the state will redeem the principal in the banks, and this will "wipe out" the created money, but not the interest, they have received. Such bonds will increase the state's spending potential, but not at the expense of anyone else's spending potential, which all classical economists would have considered a clear-cut recipe for inflation.

For centuries, the alchemist tried to extract gold from other substances, thus developing the science chemistry. Today we have finally managed to create means of payment in a much smarter and more environmentally friendly manner, namely by accounting - Foto Pinterest.

The story of how young C. F. Tietgen could pay out more money than the bank had in inventory suggests that the banks of that time used "fractional reserve banking", which correspond with the immediate perception of banking by ordinary people. That is, they mean that "deposits make lending". Customers place money in the bank for saving or to avoid storing cash, they are rewarded with the deposit interest rate. The bank retains a certain fraction - calculated by a reserve ratio - of this money for security and lend the rest to creditworthy customers, who pay the higher lending interest rate. The difference between these two interest rates constitutes the bank's profit. However, for many decades, banks have not been managed in this way.

There is a traditional and very beautiful formula for credit multiplication, which most probably describes older banking system:

A sudden saving glut has given banks an increased amount of deposits "A".

The bank decides to set reserve ratio to "r" and lends out the rest:

A×(1-r)

Very fast the lent money come back as deposits. Again, the bank applies its reserve ratio and lend out the rest:

A×(1-r)×(1-r) which is: A×(1-r)2

Very fast the lent money come back as deposits. Again, the bank applies its reserve ratio and lend out the rest:

A×(1-r)2×(1-r) which is:

A×(1-r)3

Very fast the lent money come back as deposits. The bank can then do it, again and again, an indefinite number of times.

This means that the original increase in deposits "A", now have been multiplied into:

Summa =

A + A×(1-r)+A×(1-r)2+A×(1-r) 3+ - - A×(1-r)infinite

It can be seen easily, as it is said, that this is a geometric series. The formula for the sum of an infinite geometric series from 0 to infinity is:

Summa = A/(1-a).

Where "a" is the ratio, here (1-r).

Then the formula for the "credit multiplier" in fractional reserve banking will be:

Summa = A/(1-(1-r)) which is

Summa = A/r

Where "A" is the original monetary base, and "r" is the used reserve ratio.

We see that with a reserve ratio of 0.05, the initial deposits will be increased by a factor of 20. Some say that many big banks could leverage their money base by a factor of 40, amounting to a reserve ratio of 0.025.

|

|

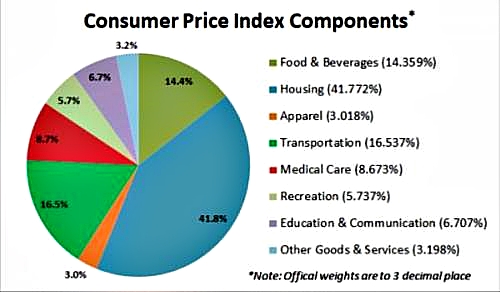

Pro Many economists of the Austrian school do not recognize the statistical truth behind a consumer price index.

The US Bureau of Labor Statistic divides all consumption into 8 categories and assigns a relative weight to each - by 3 decimal places. Apparel means clothing. Each category is more divided into subcategories. The average prices are calculated using the respective weights for each subcategory and main category and from this, a final number is calculated, which is indexed related to the same number calculated in the same way for previous periods.

Ludwig von Mises claimed that calculating a consumer price index for measuring the purchasing power of money is a fiction based on arbitrary choices of goods included in such a calculation and the relative weights with which they are included. He pointed out that the individual's choice of goods varies considerably from person to person, even within groups with similar incomes, social groups and groups characterized by the same geographical locations, and consumer preferences constantly change over time. He argued that in a market economy, relative prices and product quality change constantly and this motivates consumers to frequently change their choice of products.

His conclusion was therefore that there is no scientific way to know with certainty whether the purchasing power of money had changed over a given period. Therefore, the statistical method considered by the Monetarists as the lighthouse for controlling the money supply for the purpose of keeping the price level stable, in his opinion was fundamentally and completely wrong.

Contra: Economy is not a very exact science, and there is little doubt that a calculation of consumer price index cannot be performed with the same precision as a physical calculation of radioactive decay, but good enough for all practical purposes.

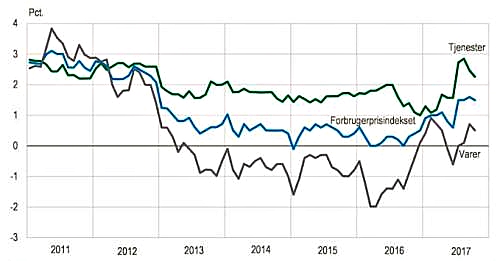

Percentage change in the consumer price index over 12 months in Denmark, which is a measure of inflation. As it can be seen, inflation in Denmark has not been alarming in recent years. It has been between 0 and 3 percent annually.

The consumer price index of Denmark is calculated using approximately 25,000 prices, collected from around 1,800 stores, companies and institutions across the country. They are not arbitrarily chosen, and they are included in the calculation with a weight based on their share of total consumption.

In "End of Laissez-Faire" Keynes made great importance of "collection and dissemination on a great scale of data relating to the business situation, including the full publicity, by law if necessary, of all business facts which it is useful to know." to make business decisions better and less based on coincidences, thereby increasing the stability of the economy and creating more respect and trust to the agents (businessmen) in the capitalism, for which we anyway have no useful alternative. Statistics Denmark's calculation of the consumer price must be attributed to such "collection and distribution on a large scale of data".

By rejecting society statistics and recommend to base decisions solely on speculative considerations, the Austrian economic school has so far placed itself on the opposite wing of Keynes. But it should not be understood that they think national economic crises are a good thing. They have their own suggestions on how to avoid the cyclically recurring crises, characterized by the business closures, unemployment and poverty that seem to be organically linked to capitalism.

|

|

The Swedish economist Knut Wicksell was a significant inspiration for both John Maynard Keynes and Ludwig von Mises.

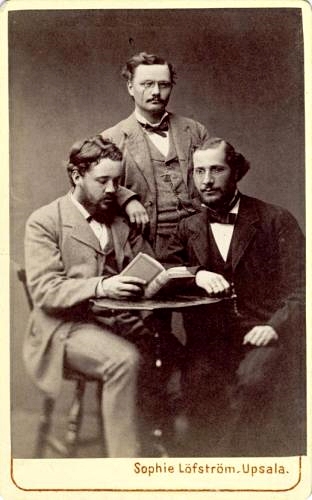

Knut Wicksell 1851 - 1926 was a Swedish professor of economics and law in Lund University. He was son of a relatively successful businessman and real estate agent. He studied mathematics and physics at Uppsala University and economics in Germany and Austria, among others at Carl Menger in Vienna. Photo: Crossing Wall Street.

It is easy to recognize several of Keynes later themes at Wicksell: the indirect effect of money supply on prices through interest rates, banks' money creation, market's insufficiency, non-gold based currencies, the need for active governments, population control and the currency policy dilemma between the importance of important export markets and national price stability.

Von Mises said clearly that he was inspired by Wicksell and his theory of the difference between the marginal return on capital and the loan interest rate deciding changes in price level.

In an article from 1907 "The Influence of the Rate of Interest on Prices" Wicksell described how the price level is determined by the difference between the marginal return on capital (which is production equipment and buildings) and the loan interest rate.

He begins the article: "The thesis which I humbly submit to criticism is this. If, other things remaining the same, the leading banks of the world were to lower their rate of interest, say 1 percent. below its ordinary level, and keep it so for some years, then the prices of all commodities would rise and rise and rise without any limit whatever; on the contrary, if the leading banks were to raise their rate of interest, say 1 percent. above its normal level, and keep it so for some years, then all prices would fall and fall and fall without any limit except zero."

Wicksell makes the thought experiment that market agents trade directly with each other without the involvement of banks. In such a case, the interest rate will naturally be determined by the expected marginal return on capital - to the extent that it can be calculated: "If we look only at credit transactions between individuals, without any interference of banks, the connection between interest and profit indeed seems obvious. If by investing your capital in some industrial enterprise you can get, after due allowance for risk, a profit of say, 10 per cent., then, of course, you will not lend it at a much cheaper rate; and if the borrower has no recourse but to individuals in the same situation as you, he will not be able to get the money much cheaper than that."

However, banks exist, and for them, money is not a scarce resource. He writes: " - they themselves create the money required, or, what is the same thing, they accelerate ad libitum the rapidity of the circulation of money. The sum borrowed today in order to buy commodities is placed by the seller of the goods on his account at the same bank or some other bank, and can be lent the very next day to some other person with the same effect." Therefore, banks can offer loans to interest rates that they themselves determine - of course, limited by competition with other banks, including international banks.

Knut Wicksell on a business card together with two unknown gentlemen. It is Wicksell standing. Photo: Sophie Lofstrom Uppsala.

There is no immediate interaction between the marginal return on capital - that is the natural interest - and the banks' lending interest rate: "But then, what becomes of the connecting link between interest and profit? In my opinion, there is no such link, except precisely the effect on prices, which would be caused by their difference."

Therefore, banks' lending rates may be below, over or at the same level as the natural interest rate.

If the banks' interest rate is below the marginal return, entrepreneurs will borrow to invest in production equipment. This will increase the demand for all types of resources, which will result in price increases. Conversely, if the loan rate is over than the marginal return on capital, demand will decrease and prices fall. There will only be price stability when the banks' rate and the marginal return on capital are equal.

However, Wicksell believes somewhat contradictory that increased activity will increase the need for banknotes and coins, which will limit banks' opportunities: " - will require more sovereigns and bank-notes, and therefore the sums lent will not all come back to the bank". This drain of banknotes and coins will eventually motivate banks to raise interest rates, and vice versa lower it by decreasing activity. It is not a limitation that exists today, as discussed above.

Only by actively maintaining lending rates at the same level as the marginal return on capital - the natural rate - can national price stability be ensured, which is an important national economic objective.

Wicksell then discusses various arguments and more or particularly less realistic options for controlling the lending rate, thereby ensuring price stability, without reaching a real solution: Banks can not deviate significantly from market prices in their industry, either individually or collectively in the nation. Perhaps one could simply manage bank prices with government decrees. As long as currencies are based on gold, the prices must follow this metal ups and downs, he wrote. One could free the currency from the gold, and - fantastic - establish a World Bank.

Pro: The repeated, seemingly inevitable, economic crises played a major role in Marxist arguments against capitalism.

The disastrous inflation and unemployment in the period between the great wars seemed to confirm this weakness of the liberal economic system.

|

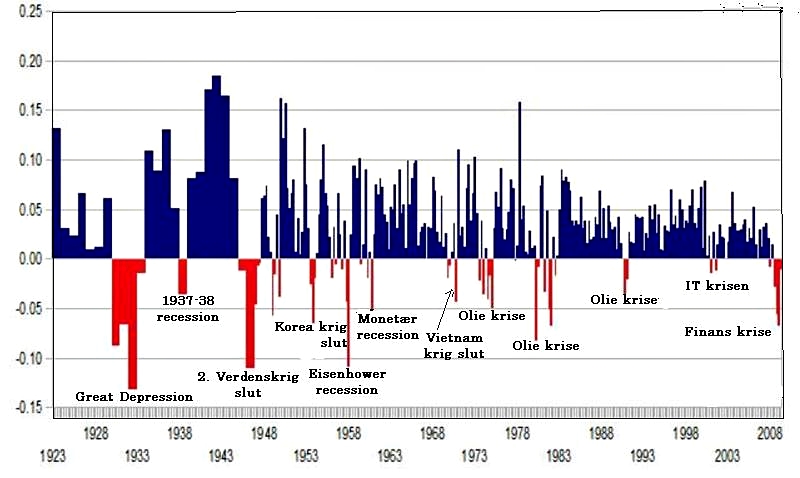

Economic crises from 1923 to the second quarter of 2009. The graph shows the annual change in US Gross Domestic Product relative to the previous year to 1946. From 1947 it is are quarterly changes. This means that if the gross domestic product is higher than the previous period, the graph is blue, and if it is smaller than in the previous period, the graph is red. The last red pillar represents the bottom of the crisis, and the last blue pillar the boom period's peak. JayHenry Wikipedia.

Ludwig von Mises argues that the capitalist system in itself does not suffer from inherent weaknesses, but the crises arise only because governments and central banks manipulate credit and money supply and disturb the market. His book "Theory of Money and Credit" contained his theory of "Business Cycle" in the form we know today. The capitalist economy can be improved by appropriate economic policies, he wrote, so that the recurrent crises can be avoided.

He further developed Wicksell's theory into his Business Cycle Theory, which describes the cyclical recurrent crises characteristic of the liberal capitalist society, characterized by business closures, unemployment and poverty.

- He describes how the agents in an economy in a sudden saving eagerness can save a bigger part of their income and thereby reduce the total demand for consumer goods.

- Government and central bank are concerned about the receding demand and decide to lower the interest rate by increase money supply to stimulate the economy, leading to the initial phase of the business cycle.

- The boom phase is characterized by that the abundant and cheap credit motivate many entrepreneurs to start marginal projects, which typically will take some years to complete. This increases the demand for investment goods rather than consumer goods. The lending interest rate is typically lower than the natural rate, and as Wicksell points out, this will create even higher prices - especially on capital goods, such as machinery, buildings and the like. Austrian economists believe that the artificial stimulation of the economy with ample and cheap bank credit simply creates the seeds of future crises; The longer this period lasts, the more serious the inevitable future crisis will be.

- The recession phase is initiated by a growing number of entrepreneurs having trouble with their financial situation because of wage increases and higher prices of investment goods inclusive materials that they did not expect, when they started the projects, before the credit increase. Increased demand for loans for the projects in trouble pushes the interest rate up and this creates further problems. At the beginning of this phase, the government and central bank may decide to create additional credit to save the distressed projects, but it will only delay the inevitable collapse of the economy, the Austrians believe.

- The depression phase is characterized by extensive unemployment, bankruptcies, factory closures and price deflation. During the great depression of the early 1930's many banks also closed and millions lost their savings. Entrepreneurs become pessimistic and discouraged.

- The recovery phase has so far historically been characterized by Keynesian initiatives, which are governments initiating large public projects, where thousands of workers and engineers find employment, thereby increasing their consumption, activating the economic wheels of society and rejuvenating optimism. The Austrian economists believe that this policy merely makes the foundation of even greater crises in the future. They recommend instead cuts in government spending, sharp control of money supply, gold-based currencies, full privatization in all industries, no public intervention in markets - nor to support agriculture. The author is not aware that such Austrian principles for full long-term recovery have been fully tested on reality.

Unemployed lining in search of jobs during the great depression. Foto: History Revealed.

Mises concludes that governments and central banks themselves bring the economy of society out of balance by excessive money creation, manipulation and mismanagement of money and credit. If only the governments and their central banks would let the market take care of itself, the Austrian economists believe, it would quickly find a perfect balance, where supply equals demand. This would entail that the economy will not suffer from the ever-occurring crises.

Contra: But is Mises' business cycle theory true? In present day, the European Central Bank, the Federal Reserve in the US and the Bank of Japan have pumped an unprecedented amount of liquidity into their economies, without giving rise to any particular inflation in the prices of production equipment for groceries, only stocks and property prices have noticeably increased.

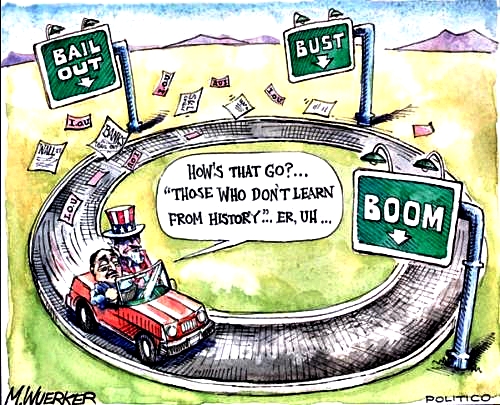

Satire over the Austrian economists, which makes fun that they believe that all crises are of the same nature and undergo the same phases. But can it be rejected that the Austrians have a point? That easy access to credit tempts businessmen to start projects, based on volatile and superficial human needs. When then a random external cause pushes the cardhouse, consumers will turn their backs on the new products, and it may start a crisis. Drawing by M. Wuerker in Commercial Finance.

It has been argued that all economic crises do not have the same nature and the same reasons and basically, it is not the same pattern that repeats again and again.

Thirties US crisis was undoubtedly caused by an imbalance between supply and demand. The American industry was the world's most effective. It produced all kinds of products. But the potential customers, ordinary people, had no money to buy for. There had been created some money, as the Austrians rightly point out. But money was only gone to those, who already had. Therefore, there was a boom in equities prior to the crisis.

The oil crisis in 1973 was caused by that the Arab oil suppliers closed for the oil to protest against Western support for Israel's warfare.

The financial crisis in 2008 was triggered by falling housing prices in the US in conjunction with a number of bankruptcies and foreclosures.

During the 2008 crisis, Roskilde Bank was declared insolvent and it was taken over by Danmarks Nationalbank and Private Contingency. This note was hanging on the entrance door Monday morning, August 25, 2008. Photo Mogens Engelund Wikipedia.

But one must admit the Austrians that the current crisis in Zambia and many crises in South America were due to excessive money creation.

The Austrian economists seem to think that entrepreneurs react fairly automatically to the indications of investment-theoretical models, such as a positive present value or an advantageous internal interest rate. However, many believe that real life entrepreneurs and project makers are not such unconscious lemmings that they immediately take action without assessing the risk of inflation during the project period.

The Austrian economists have an excessive belief in the market. "The market is always right", is a typical "Austrian" statement. As long as governments and central banks will let the market take care of itself, it will settle in a perfectly stable equilibrium, as can be shown with Say's law and the Quantity Theory of Money from the classic economy.

The Austrians believe that when governments only leave the economy to itself and ensure that it is not affected by individuals' politically motivated decisions, its built-in market forces will make it automatically optimizing itself.

A perfect competition market could be expected to have this property. Perfect competition is characterized by that there are many sellers and buyers, who do not know each other - such as for example in the market for vegetables or fish.

|

Typical retail from around 1930, when Mises wrote his books.

When Mises described his business cycle theory in the years after World War II, many markets in the European nations and the US were really characterized by many sellers and many buyers. There were small farms and local furniture factories, countless family shops, wholesalers, craftsmen and traveling salesmen. They were markets that were quite close to perfect competition, and in the main governed by the classic market forces, as preconditioned by the Austrian economists' proposals for an efficient economy. But one by one all the family shops and the small craftsmen have given up. Today, only a few have their own, and most markets can be characterized as oligopolies, which are largely governed by the decisions of a few major agents, who know each other.

|

|

Pro: The most peculiar of the Austrian theories is "The case of free banking".

Mises and Hayek believe that a completely free banking market combined with a return to the gold standard would be an important contribution to a final solution to the "Business Cycle" problem.

Putin inspects the Russian gold reserves. There have been several articles in RT that both the Chinese and the Russian Central Bank are buying gold for the purpose of introducing an international gold-based settlement system that will compete with the dollar as the international settlement currency. Foto RT.

All legal restrictions on banking should be abolished. The central banks' monopoly on currency issuance must be abolished, and it must be free for any bank to introduce their own currency based on gold or silver.

Mises explains the advantages of the gold standard many times, but most extensively in an article from 1965, "The Gold Problem": Why have a monetary system based on gold? Because, as conditions are today and for the time that can be foreseen today, the gold standard alone makes the determination of money's purchasing power independent of the ambitions and machinations of governments, of dictators, of political parties, and of pressure groups. The gold standard alone is what the nineteenth-century freedom-loving leaders (who championed representative government, civil liberties, and prosperity for all) called "sound money.".

He continues: "However, since such a gold-based monetary system still will be set up by the political authority and governed and monitored by the political authority or its designated institutional agent, even a gold standard will be open to state intervention and manipulation."

Only in conjunction with a completely free banking market, Business Cycle's booms and crises can be finally reduced or eliminated, Mises said.

German reich banknote from 1923 denominated 50 million mark. Photo pxhere.

This led Mises to the conclusion that regardless of the shortcomings or problems that may be in the idea of an unregulated free banking system, all such criticisms should turn pale to insignificance in relation to the politically created monetary chaos during World War II and beyond. The destruction of the German mark during the great German inflation in the early 1920's is just the most important example, he thinks. The only monetary system and banking system that would have the potential ability to minimize, if not prevent, monetary abuse by governments would be a free banking system.

It will no longer be necessary to maintain legal constraints on the private banks' money creation, such as minimum reserve requirements and the like. Thanks to the demand for the gold-solvency of their currencies, market forces will keep the individual currency-issuing banks in check, so that they do not exaggerate their money issuance.

JPMorgan Chase is one of the world's largest banks headquartered in New York. Its Houston Texas branch includes one of the world's tallest buildings, the JPMorgan Chase Tower. JPMorgan Chase would be one of the private banks that would be able to issue their own currency if the Austrian economists' visions were realized. Photo Gabor Eszes Wikipedia.

Karl Hayek also outlined a system of free and competing private banks beyond government control, which would provide the market and society with money. He used the term "private competing currencies" by which he lined up with Mises's idea that private banks should be entrusted to issue alternative currencies. The issuing banks should promise to keep the value of their private money constant through extensions or withdrawals of their monetary units in circulation. He said: "There can be no more effective control over governments' abuse of money than if people were free to refuse money they do not trust and prefer money that they trust."

Ludwig von Mise's modern American supporters have taken the case of "Free Banking" completely to their hearts. They argue that only a completely free banking sector, regulated only by market forces, could successfully regulate the monetary system. Such a market-based monetary system would be free of political abuses and agendas and thus be able to ensure a stable economy of society.

Industrial & Commercial Bank of China headquarter in Beijing. The Bank is one of the world's largest measured on assets and one of the world's most profitable. It is one of China's four major state-owned banks. The other three are the Bank of China, the Agricultural Bank of China and the China Construction Bank. It must be an obvious candidate for issuing its own bank currency, when the Austrian economists' visions on private bank currencies may become reality. Foto Wikipedia.

During the international gold standard, before the world wars, the nations' central banks were obligated to redeem its currency in gold to other nations. A nation, that solved their financial problems by letting the banknote press run, would thus be punished with correspondingly increased claims on their gold reserves. The years before the world war were for that reason characterized by very stable international exchange rates.

Let us imagine a private currency issuing bank, which has been tempted to let the banknote press run. The large number of banknotes that they emit will sooner or later end up in other banks' holdings. These other banks will go to the issuing bank and demand to have the banknotes redeemed with gold.

BNP Paribas is a French multinational banking and finance group headquartered in Paris. In 2013, it was the world's fourth-largest banking group, measured on assets. Photo pxhere.

The bank, which has over-issued currency, will see its gold reserves dwindle and thereby be motivated to give its printing press a break.

It will work somewhat in the same way as when de Gaule in the years up to 1972 often required the Federal Reserve to redeem the French holdings of dollars in gold.

Supporters of the Austrian economic theories believe that market forces would be a much better guarantee of a sound monetary policy than politically appointed central bank managers can be. With the help of such a free banking sector, the monetary system can be freed from the politicians' abuse and provide the basis for a liberal capitalist economy free of cyclical recurrent crises.

Gold, the magic and fateful metal. Apparently Scythian gold figurine, three thousand years old. Nevertheless fascinating. Foto Pinterest.

Contra: But banking market is not a perfect competitive market, where Adam Smith's invisible hand is supreme ruler. It is - like so many other modern markets - an oligopoly market dominated by a few very large agents, who know each other and probably meet regularly. They will send Adam Smith's "Invisible Hand" to retirement and meet discreetly at an expensive health resort in Switzerland. There they will agree on how to cut the cake.

We believe that the Danish Danske Bank, Nordea and Jyske Bank are big banks, but they are only small convenience stores, compared to the really big ones, such as JPMorgan Chase, Bank of America, Industrial & Commercial Bank of China, China Construction Bank, BNP Paribas , Citi Group, UBS, Barclay and so on. And an entirely free banking market as the Austrians are professed to, must also mean that international banks will be allowed to operate fully also in Denmark and Scandinavia.

Perhaps the new currencies will be named like "Citi Group Credits", "UBS Notes", "International Yuan" or similar.

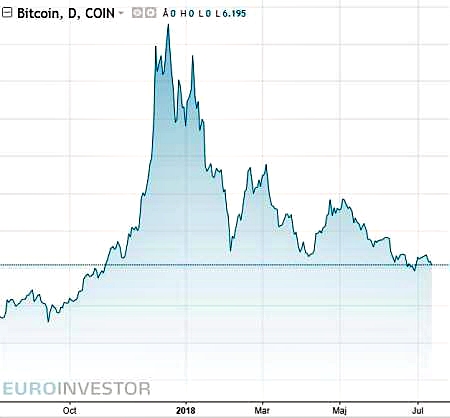

The possibly future private banking currencies will perhaps recall Bitcoin and other crypto-currencies. However, the major international banks will be far more visible as responsible organizations behind their currencies, than the background of bitcoin. In addition, we see that bitcoin varies several hundred percent within a year, making it unsuitable as a medium for savings. It is also in clear downtrend, like the many other crypto-currencies. Photo Euroinvestor.

The US savers will wring themselves out of the traditional political parties' grip on their savings - Republicans, Democrats, Social Democrats, Liberals, and so on - but realizing the idea of free banks will deliver them to an even more dangerous international political party, namely The Davos Party, a conspiracy of unbelievably rich people, created by globalization. They want to break down the nations and establish themselves as world leaders.

If the Austrian vision of free banks is realized, we must feel the greatest compassion with future auditors and other economy managers. The individual companies' accounts will be flooded with a confusion of currencies and ever-changing mutual exchange rates. In the border city of Flensburg - between Denmark and Germany - prices are quoted in two currencies only, namely in dkr and Euro, but in the future all prices may everywhere be stated in many different bank currencies.

The central bank in Russia increases the country's gold reserves to meet the objective given by President Putin to make Russia less vulnerable to geopolitical risks. As of November 2017, Russia had 1,801 tonnes of gold, accounting for 17.3 percent of all reserves. Russia is the sixth largest gold owner after the United States, Germany, Italy, France and China. Photo Pavel Lisitsyn RT.

The advent of bitcoin gives us an idea of how such private currencies can work. The exchange rates are extremely volatile making the currencies unfit for ordinary trading and savings.

|

|

| To top |