| Home DH-Debate |

| 1. Oligopoly | 2. Oligopol Behaviour |

| 3. Financial Markets |

The Scotsman Adam Smith described in 1776 the free market in his work "The Wealth of Nations."

Adam Smith.

If only the market forces are allowed to act freely, they will by themselves create the optimal prices. There will be no need for administrative price regulations. The "Invisible Hand" will automatically create the reasonable prices to the best for the society. The government should do nothing and leave the economic decisions to the businessmen and the consumers only.

Customers will generally only buy, if the price is low, and the businessmen will only send goods to the market if they are rewarded with a reasonably high price. After some time a balance will prevail based on these two opposite interests, which is the market price.

Thus, in the long run, the market price of a commodity will consist of the costs, which it had caused, and a reasonable profit to the businessman.

This is the beautiful economic model, that we know so well, the increasing supply as a function of the price and the decreasing demand also as a function of the price. Where the two lines intersect each other, they define the market price, represented by a vertical dotted line down to the horizontal price axis.

Independent fishermen in the sixties with small boats.

If one did not study economics at the university, it's exactly how we perceive the "free market", which is so important for our political views.

However, this model applies only to perfect competition, which mainly means, that there are so many suppliers and so many buyers, that they individually cannot influence the price.

The market for vegetables, sold at the morning market of the Gardeners Sales Association, is a typical example of "perfect competition". The market for fish, fresh from the fishermen's boats, is also a good example of

"perfect competition".

The individual gardeners or fishermen can meet and talk about the difficult time for their trade. They can drown their sorrow in a glass of beer or a cup of coffee, but they cannot really do anything about it. The prices are controlled by the anonymous market forces, Adam Smith's "invisible hand", that's the way it is.

Family shops in the fifties.

Many of our parents and grandparents fifty years ago had "their own". There were farms as small as 6 hectares of land. There were fishermen with only a few rowing boats using stationary nets in shallow water. Small local shops, local banks, lawyers and traveling salesmen were everywhere. All kinds of manufacturing were still going on in this country. There were still local furniture factories and shoe factories. They all participated in something close to perfect competitive markets because there were many suppliers as well as buyers. For our forefathers, the idea of perfect competition was simply identical with the idea of the free market and closely connected to the idea of political freedom.

But it was in the good old days. The world has moved on. A few very big suppliers characterize most markets today.

A handful of supermarket chains have replaced the small grocery shops of the past. In the old days, parents could send the children down to the local shop and buy on the "book". Nowadays one has to take the car and go to the nearest Netto, Bilka, Aldi or Brugsen and buy the goods for daily needs.

All goods and services are supplied by some very big organizations. SAS, Lufthansa, British Airways, and so on provide air travels. Pequot, Mercedes, Toyota, etc. supply cars

And when and if such huge organizations meet to talk about the bad time for their trade, they do not need to drown their sorrow. They are able to do something about it. Adam Smith's "invisible hand" has lost its strength.

Oligopoly is a market form, where a few very large suppliers dominate the market. Most modern markets are oligopolies. Coca Cola, Pepsi Cola and Schweppes dominate the market for soft drinks. Carlsberg, Heineken, Budweiser, Corona and a few others dominate the beer market. Danske Bank, Nordea and Jyske Bank and a few others dominate the Danish banking market. Virtually every single market for goods and services is currently dominated by a handful of very large international firms.

The economic model with the declining demand curve and a steadily increasing supply curve, where the intersection point defines the market price, is only valid for "perfect competition". In the modern market, the "oligopoly", there is also a kind of market price, but it is different and more difficult to analyze.

Oligopolies have for years been in the searchlight of the authorities. They have been suspected of collaboration "under the table" in order to exploit the consumers in an unfair way. Such cooperating large firms in oligopolistic markets are in the U.S. called for "trusts" and in Europe for "cartels".

At universities and business schools great emphasis are still placed on the teaching of "perfect competition", this despite the fact, that it nowadays only can be found in a very few business areas. Perhaps because over time a large amount of teaching materials in "perfect competition" have been developed. There are plenty of problems in this subject; the teacher can give to the students. Moreover, "oligopoly" is a rather difficult subject, which is not so easily analyzed. It is, so to say, not well suited for teaching.

The word oligopoly comes from Greek and means "few sellers. "Oligopoly", it sounds almost like a rare economic disease.

But markets with a few easily identifiable suppliers, who know each other, so to say in person, is really a very old and widespread phenomenon. Throughout the Middle Ages, all craftsmen and Merchants were members of their respective The Guilds that decided the prices and supervised quality. The guilds represented their members in front of the king and his government.

It's easy to imagine, that a master craftsman or a manager can develop a kind of understanding of his competitors in the same trade. Every day they must face the same sort of problems as himself, with quality, technology, customers and employees. One can easily develop the feeling, that you know this man. The next logical step will then be, that when we now know him, you can also trust, that he will keep an agreement.

A traditional master craftsmen plot describes very well, how an oligopolistic market can work.

In a provincial town, the municipal engineer offers a public construction work in competitive bidding. The managers of the local small construction companies meet in the lodge and decide among themselves whose turn it is to win the competitive bidding. The chosen small company submits an offer, which gives a comfortable profit. All his accomplices also send offers, but they shoot well over according to their mutual agreement.

The only way, the municipal engineer can defend himself against this kind of plot, is by involving companies from outside the provincial town in the competitive bidding, other companies, which are eager to enter the market, and where the managers don't know the local managers of the local firms personally. They can be from a completely different city, or in as the last resort, from abroad.

"Follow the Leader" strategies are also characteristic for oligopolies.

A market is dominated by a handful of large international companies. One of these companies is the most cost-efficient. This company first opens the game and set the price. All the other players tacitly put up their prices in line with "The Leader". None of them have the urge to engage in a price war against the most cost-efficient company. This would only lead to bankruptcy and ruin.

The price, which in this way is put up, is, of course, a market price in the sense, that the goods are actually traded at this price. But it is still different from a traditional "perfect competition" market price, which consists of the costs plus a reasonable "survival allowances" for the businessman. An "oligopoly" market price will generally contain a higher percentage of profit to the seller.

In the struggle for survival in the economic jungle, it is a great advantage to be big.

A large international company, who participates in an oligopoly market, will have significant economies of scale in both purchasing, production, distribution and marketing. It may well be, that although it has a relatively large percentage profit margin, then their prices will still be well below, what a traditional family business can survive for in today's world.

Participants in an oligopoly are typically not very interested in overcoming their rivals completely and become a monopoly. Monopolies are constantly in the searchlight of the government authorities eye and can be exposed to all sorts of interventions and regulations. Customers don't like them and are accusing them to charge overprice and to be sloppy with quality. Microsoft is a frightening example. It is far more beneficial to stay as an oligopoly in a longstanding friendly competition with other large firms in this market and enjoy the nice profit, which the market participants informally have agreed to take.

All the expensive ads for international brands often do not mention the price. Ads for Coca Cola and Pepsi Cola run on lifestyle, identity and hidden sexual motives. Ads for OTA Sun Grain and Kellogg Corn Flakes runs on lifestyle and tradition. Ads for cars underline the status, which the owner of this brand will enjoy, and the dynamic and virility, he will radiate.

In oligopoly markets, there often is a significant element of cooperation.

Again and again, it is seen, that a deputy manager from the dominant firm will be hired as top manager for the nearest competitor. He will often be preferred for the company's own homegrown candidate. Maybe he felt ignored in connection with the occupation of an even higher position in the dominant firm. In many industries, corporate executives change very often, maybe every three or four years. Inevitably they establish a network of acquaintances in the industry, former colleagues, former classmates, friends from meetings and seminars in professional associations and so on.

If a technician, employed by one of the oligopolistic firms, applies for a job at one of the other companies in the market, it is most likely normal for the responsible manager to make a discreet and private telephone inquiry at his acquaintances in the other company.

Since it is more or less the same people, who are in charge in all the companies in the market, one will find, that the corporate culture, organization and working methods are quite similar. It no longer says: "We have always done it in this way here in the company.". Now it sounds more like: "This is how we did in my earlier, more successful company." Yes, even the products are now more and more alike. Earlier one could on a long distance distinguish one automobile brand from another, now we often have to go close and look at the label on the front. Today, most brands of beer taste more or less alike. It will rarely be possible to distinguish the taste of one brand of beer from another if you drink them blindfolded.

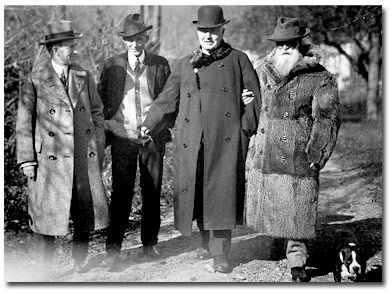

Harvey Firestone, Henry Ford, Thomas Edison and Burrows

Personal friendship between the owners of the firms associated with the same industry may also be the basis for cooperation. A famous example is the longstanding friendship and cooperation between the owners of Ford Motors and Firestone Deck in the U.S.

Henry Ford and Harvey Firestone both were sons of farmers and both had mechanical skills. Firestone Tire and Rubber Company supplied the tires for the famous Ford T model. Henry and Harvey got sympathy for each other and became friends. They often went on camping and fishing trips together. One can imagine, that they made important business decisions while sitting in the boat waiting for bid. Just like many important decisions today are said to be made on the golf course.

Oligopolistic firms want to expand. It is said, that they can expand horizontally or vertically.

To expand horizontally means to acquire other companies in the same industry. This is the process, which we hear on the news every week. Now, this or that famous company has purchased one of its smaller competitors. Danske Bank acquires BG Bank, Lufthansa buys Swiss Air, Aventis acquires Hoechst, Adidas take over Reebook, Royal Unibrew buys Albani, Grundfoss buys Italian Tesla, Vattenfall buys Fyn's Powerplant and in this way the development continues week after week.

To expand vertically means, that a company increases the control of its subcontractors and suppliers, and on the sales-side, of its distribution channels. Starbuck tries to gain more control over its raw material supplies by buying coffee beans directly from coffee growers in Kenya or Ethiopia and thereby bypass coffee brokers. HBO is seeking more control of purchasing by producing its own series, like "Rome" and "Deadwood" instead of buying movies from film studios. On the sales-side, the B&O company from Struer is seeking more control over its distribution channels by establishing its own network of B&O stores.

The current trend among oligopolistic companies is to focus on their core business.

For example, Pepsi Cola sold its shares in Taco and Kentucky Fried Chicken to concentrate on its core business, which means the well-known soft drink. Apparently, they think, that the competition in the oligopolistic markets with certainly will end up, that in the world there will be from two to perhaps five large international companies left in each business area. If a company wants to be among them, it must concentrate on, what they are good at, which is its core business.

The latest trend in strategy is the notion of "Relation Marketing". It will give Adam Smith's "invisible hand" even more serious muscular dystrophy. According to this strategy, the company must seek long-term and stable relationships with customers and suppliers. Something like the famous relationship between Ford Motors and Firestone. This can save a lot of money in purchasing and sales departments, it is said. The good old procurement procedure to obtain three to four offers and then selects the best one, that will soon be history. Quality control and inspectors will not be necessary anymore. Bad debtors will be history.

"Relation marketing" will really mean, that the oligopolistic firms in the future will make business with other oligopolistic firms in other business areas only. For example, the contractor company Skanska will buy mineral wool from their chosen supplier Rockwool only. They will constitute an impenetrable network, that it will be very difficult for new firms to find a foothold in.

As mentioned above oligopoly involves a fairly large element of collaboration with other companies and organizations, not to underestimate governments. Leaders of the oligopolistic firms must be trustable personality types, who are able to forge friendships with business partners. They must have something of the same characteristics as politicians.

The worst thing, oligopolists know, is that a newcomber will seek to get a foothold in their market in order to gain a share of the profit. This causes price competition, lost profits and lost market share if they fail to refuse the intruder. It is possible to enter an oligopolistic market, but it requires a very large marketing budget.

In this sense, they will get a challenge in the future. Indians and especially Chinese people are tired of being the place, where everything can be produced cheaply, while the international brand owners sell the same product expensive in the West and carry away most of the profits.

For example, a shirt, which can be manufactured in a suburb of Guangzhou for, let's say, $1.5, to be on the safe side. The same shirt can be sold in the West as a famous brand for, let's say, 8 to $10. The profits of globalization are of this magnitude. This are the kinds of profits, which, especially the Chinese want to have part of. They are one of the main causes of the big international companies current Bonanza.

In the official opening speeches at exhibitions and fashion festivals in China, it is openly declared, that their goal is to create their own Chinese brands in all commercial areas. In the business broadcastings of the Chinese television channels are brought interviews with well-known American professors, who give advice on how to establish their own brands. Already the Chinese laptop "Lenovo" sells as number three on the world market. The Chinese washing machine manufacturer, Haier, have already established a factory in the United States.

There can no doubt, that within 10 to 15 years Chinese brands will be present in all markets. They will offer the same as the existing oligopolists, only cheaper. It will be a difficult time for the, now so cocky, international companies.

Large international companies are often huge organizations with tens of thousands of employees, organized into a maze of special functions, planning, logistics, technical support, etc. The connection between the efforts of the individual specialized employee, the market and the company's ability to achieve its goals can be quite confusing. Therefore, it can be very difficult to judge how much a specific employee's efforts and decisions contribute to the organization's profits in the long term.

"Management Accounting" is a technique, which has been developed to monitor each department's contribution to achieving the company's goals, usually something with profits in the long term. The concept is to compare sales and profit with the relevant actual costs. This implies standard unit costs, flexible budgets, cost allocation, and much more. It is important to have a parameter for the activity, such as units produced, units sold, patient bed-days, number of tons produced, etc. Such a technique allows management of large international companies to identify units that require increased attention.

But as said before, it requires, that one has a suitable parameter, which describes the activity. For numerous departments such as technical support, development, customer support, human resources, and so on, and for whole business areas, it is often not possible to describe the size of activity with a parameter. Therefore, it can be extremely difficult to find out how much they do, and if their doing is useful, and if output from their department is in the right proportion to their costs. Often one gets the impression that they simply use the money, they have available.

It is an enormous advantage to be big. Nowhere is this more evident than in the market for capital, especially the stock market.

There are two kinds of agents in the stock market.

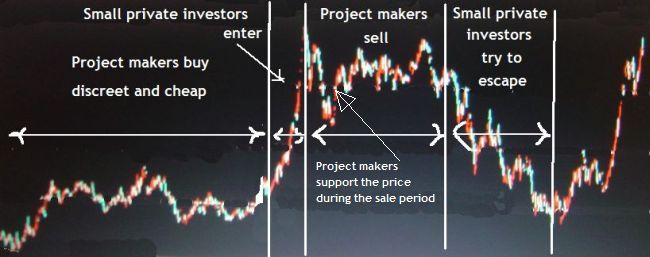

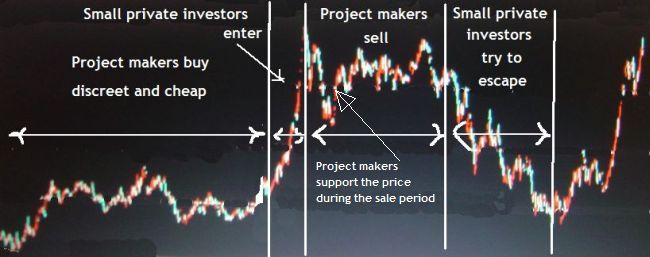

The big investors have the power to make the share prices go up and down.

The first kind is a large number of private individuals, who are trying to create a return on their modest savings. For them, the stock market looks like a perfect competition market. They can only try to predict in what direction, the prices will go, and then dispose accordingly. Individually they cannot influence prices.

The second kind is the big investors, banks, mutual funds, hedge funds and the like. They have usually better information. They have millions and billions at their disposal. For them, the market is an oligopoly. When they decide to take an interest in a particular kind of shares, it will affect the price of this share. Because of their volume they can individually make the price of some stocks to rise or fall by buying or selling.

|

The bubble method in collaboration with the management of the selected company is very effective.

The stock market is a "zero game". What some are winning, others are losing. If the big investors have good profits, there are others, probably some small investors, who have losses.

| To top |